VBAs act as your invoicing watchdog, diligently sending reminders and following up on outstanding invoices. They interact professionally with clients to ensure the difference between the direct and indirect cash flow methods that you get paid on time. This proactive approach improves your cash flow and prevents revenue delays that can hinder growth and investment opportunities.

Prepare And Send Invoices

The cost for bookkeeping virtual assistants on Upwork varies depending on the specific freelancer’s skills and experience. When it comes to bookkeeping virtual assistant services, RemSource is one of the top names in the industry. Founded in 2009, the company has been providing businesses with the fully-managed virtual assistance they need to stay on top of their financials for over a decade. Having an average experience of 12 years, the VAs of Time etc are highly detail-oriented, which ensures that your books are accurate and up-to-date at all times. The company offers a rollover of hours and any unused hours can be carried over to the next month.

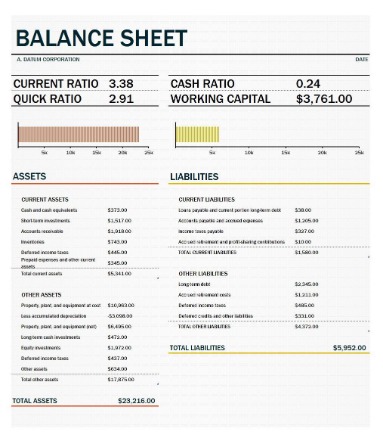

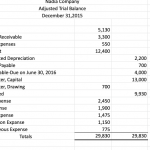

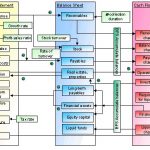

Documentation of Financial Records, Including Balance Sheets and Ledgers

There are so many options and it’s hard to know which ones are legit and which ones will just take your money and run. Yes Assistant LLC provide a well-organized and flexible virtual assistant service. We give you more time to focus on the big picture by taking care of the little details.

Wing Assistant – Effortless Communication For Seamless Bookkeeping

Bookkeeping virtual assistant services offer more than financial management tools. The future emphasizes accounting virtual assistant roles in business strategies, marking a new era of financial management focused on efficiency and foresight. The future of bookkeeper virtual assistant hiring looks promising, thanks to ongoing technological advances. As businesses embrace digital bookkeeping, virtual assistants become essential for success. Moving from traditional methods to digital tools shows the industry’s drive towards better efficiency, accuracy, and growth.

If you are looking for a virtual bookkeeper who will do more than just bookkeeping, you should check out 24/7 Virtual Assistant. They manage your business finance, remind you to pay bills, help you calculate https://www.quickbooks-payroll.org/ tax, and manage money. Finances can only be managed by systematic, organized tracking of inflow and outflow of money. That’s why you should consider handing over your finances to a virtual bookkeeper.

- Financial reporting is all about taking the numbers and transactions from your business and turning them into clear, easy-to-understand reports.

- Having an extra set of eyes looking over your expenses is an invaluable way to evaluate where your money flows every month.

- While most virtual assistant bookkeepers know how to use essential accounting software, it’s best to hire someone who’s up to date with the field’s technological advances.

- Some bookkeeping experts also recommend changes you should make to increase the firm’s profit.

How to Hire a Virtual Assistant Bookkeeper?

Look for bookkeeper VAs through reputable platforms such as Rapid Assistants, which specializes in providing skilled virtual assistants. Check their credentials, experience, and reviews from previous clients. Conduct interviews to assess their expertise and compatibility with your business needs. A virtual bookkeeper handles your bookkeeping remotely—they may not be in your town or even your time zone.

Technology plays a key role in improving virtual assistant bookkeeping. It includes modern software, cloud storage, and automation, helping virtual assistants deliver timely financial insights, manage transactions better, and report finances accurately. Businesses should adopt the latest technology to get the most out of virtual assistant bookkeeping services.

Reconciliation is the process of comparing financial transactions to existing financial documentation, and it’s a critical job. Not carried out correctly, reconciliation can not only provide a distorted view of an organization’s financial health, but also cause legal issues. Thankfully, experience in reconciling financial records and bank statements will give you the confidence to tackle this with ease.

The healthcare industry is seeing a surge in virtual assistants (VAs), particularly from the Philippines. Their strong work ethic, medical knowledge, and cultural fluency make them ideal for streamlining operations, boosting patient experience, and freeing up medical professionals’ time. Clearly define expectations and tasks, provide secure access to your financial accounts and software, and offer comprehensive training on your unique systems and processes. By investing in a thoughtful interview and onboarding process, you’ll build a strong foundation for a successful and long-lasting partnership with your bookkeeping VA. Moreover, once you hire a bookkeeping virtual assistant, you can manage and monitor them effortlessly with the tools we covered above. This means the bookkeeping virtual assistant you hire has to be familiar with accounting rules in your niche.

Organizing and maintaining these different client accounts is difficult and cumbersome. A virtual bookkeeper will know of different software that can easily track these transactions for an easier experience. Since you’re hiring by the hour, any work that you need to be done (big or small), you’ll only need to pay the virtual bookkeeper for the hours that you’ve hired them.

Try to understand what tasks and responsibilities you will delegate to a VA before seeking one. This practice is about gaining clear insights into your financial health, enabling informed decision-making. First off, you’re not spending extra on office space, equipment, or utilities since the assistant works remotely. Instead, https://www.accountingcoaching.online/the-straight-line-depreciation-method-its-effect/ you can channel your energy into strategic planning and growth. This involves record-keeping, updating employee details, calculating overtime, and ensuring compliance with federal and state regulations. Services can be scaled up or down according to business requirements, providing flexibility in managing resources.

One of the best skills to have on your side as a virtual bookkeeper is the ability to communicate effectively. Working in an accounts department, you will regularly be communicating with all the other teams in the business. This means that you will be dealing with a wide range of people in different roles.